Farmland Value Trends in Illinois, Minnesota and Wisconsin

Out here, anything is possible. Even in a year defined by tighter margins and economic uncertainty, farmland across the Upper Midwest continued to demonstrate resilience in 2025. Producers navigated tighter margins, shifting commodity prices and broader economic uncertainty, yet land values held firm across much of the region.

At Agri-Access, we believe land represents opportunity. Through consistent analysis of benchmark properties, we track how economic pressures influence farmland values, transaction activity and buyer behavior across key agricultural regions. These insights help lenders and landowners better understand where the market stands today and how it may evolve in the year ahead.

Benchmark Trendlines of Farmland Values

Our benchmark trendlines follow 53 farmland properties across Illinois, Minnesota, Wisconsin, Iowa and Indiana. Updated monthly, these appraisals offer timely perspective on regional market conditions and reinforce the importance of informed decision-making in a market that remains steady, yet watchful. Limited land supply, ongoing investor interest and strategic expansion by owner-operators continue to support farmland values as 2026 begins.

Explore the state-by-state trends below to see what is shaping farmland values and where opportunity may lie.

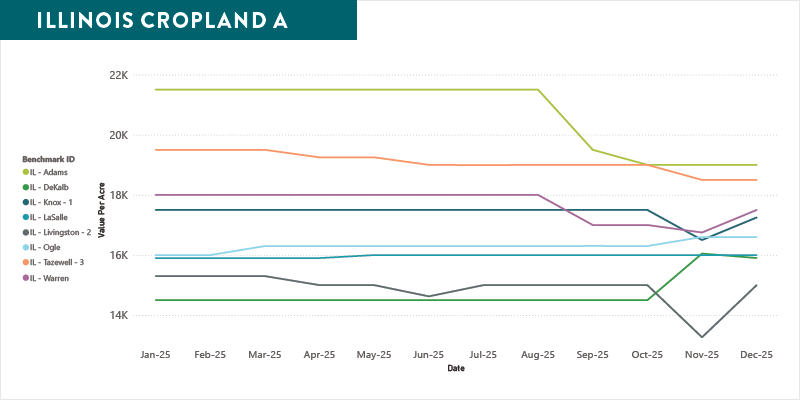

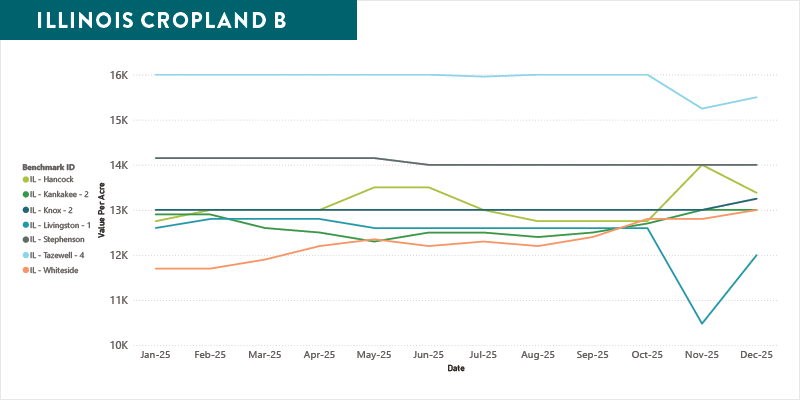

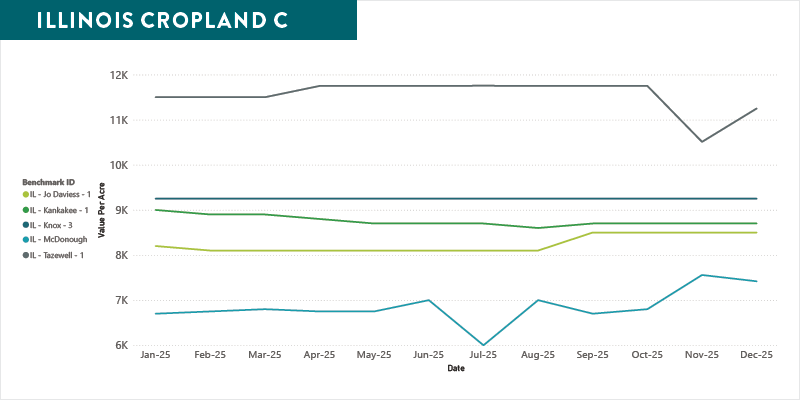

Illinois

Farmland markets in Illinois reflected a balance of challenge and opportunity in 2025. Lower commodity prices weighed on farm profitability, yet farmland values across the state remained largely stable.

Illinois is comprised of multiple distinct market areas, each influenced by unique soil characteristics, productivity and buyer demand. These regional differences play a meaningful role in shaping overall land values. While transaction volume declined compared to prior years, year-end auctions helped establish pricing signals heading into 2026.

Demand for quality farmland remains strong. Limited alternative investment options, interest from expanding operations and premiums paid for land near existing holdings continue to support values. Investor participation also remains a steady presence in the market.

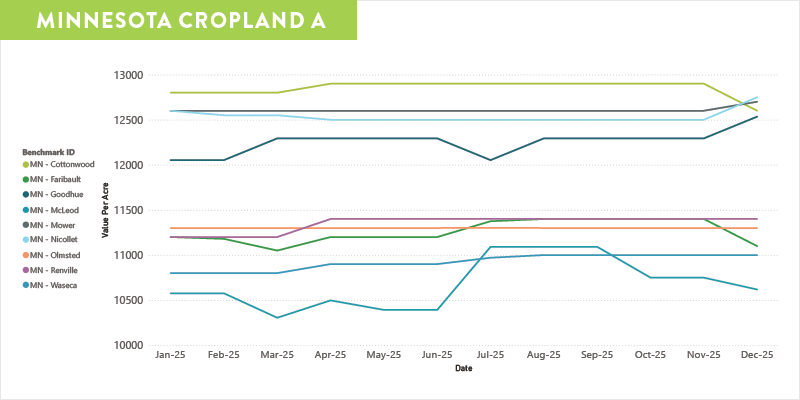

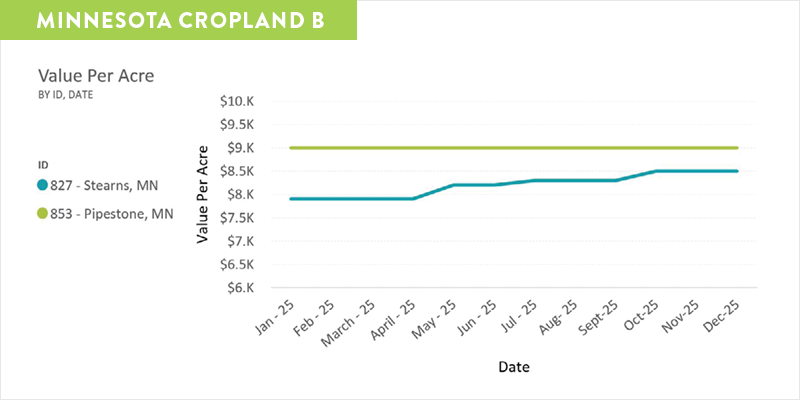

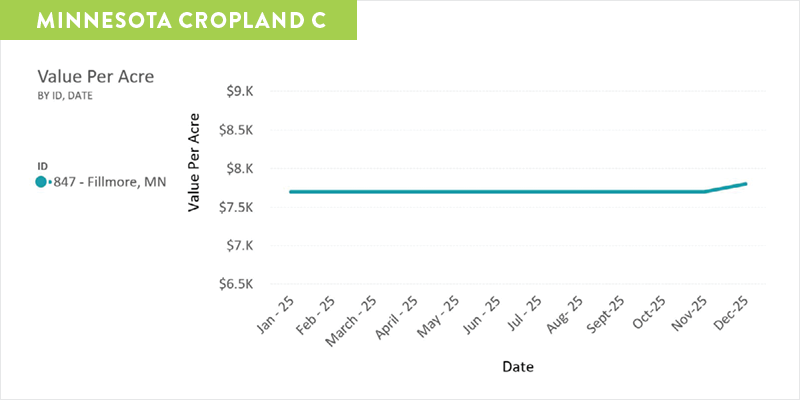

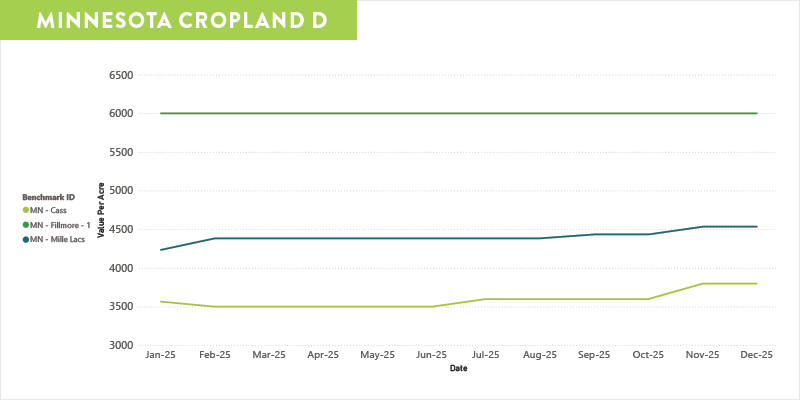

Minnesota

The Minnesota farmland market experienced mixed trends through 2025. Land values peaked in many areas during 2023, with top-end sales reaching $14,000 to $16,500 per tillable acre and select parcels exceeding that range.

Supply and demand remain the primary drivers of value. Areas with limited recent sales and strong livestock presence continue to command premium pricing. Over the past year, owner-operators accounted for a greater share of purchases, often paying premiums for parcels with strong soil productivity, favorable layouts and minimal operational challenges.

Conversely, areas with higher volumes of listings experienced price declines of approximately 15% to 20%. Lower-quality parcels and those with drainage or access limitations saw the largest adjustments.

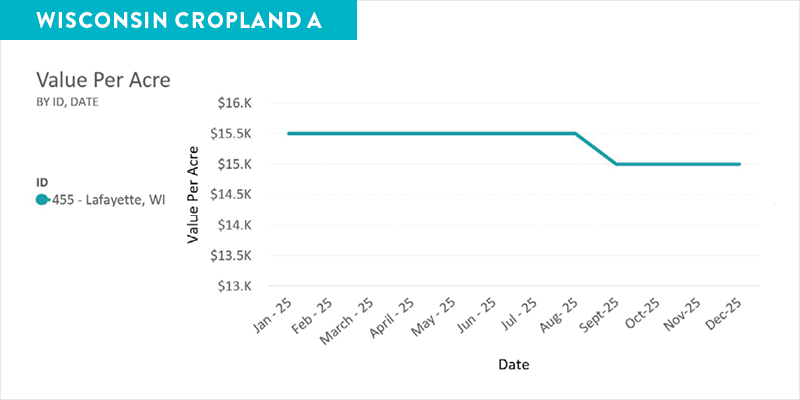

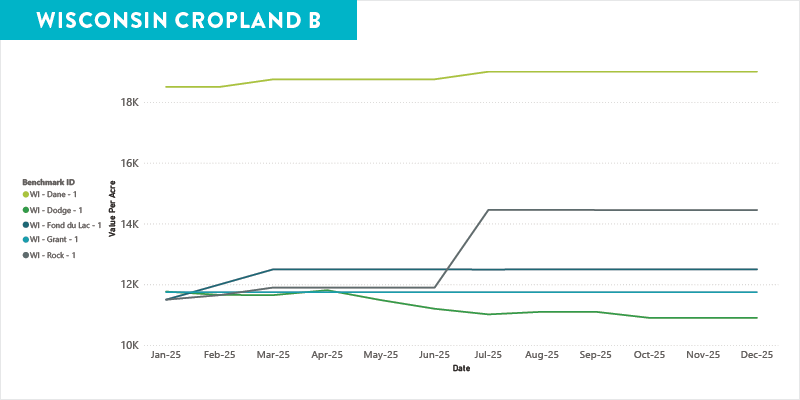

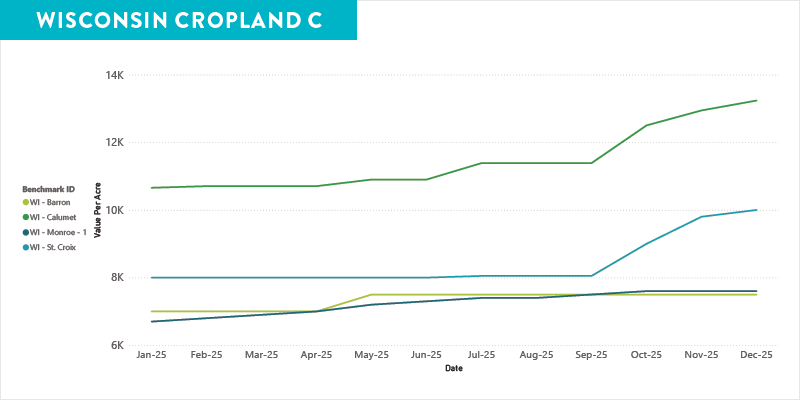

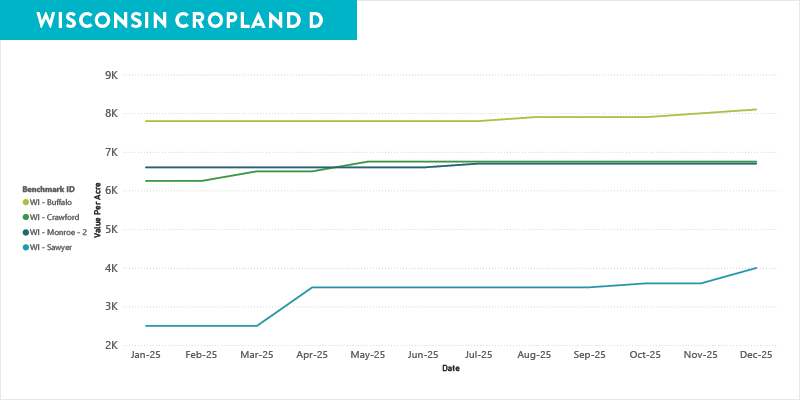

Wisconsin

Wisconsin farmland values remained strong throughout 2025 despite tightening margins for crop and dairy producers. Benchmark data showed year-over-year increases of up to 25.9%, with an average gain of approximately 10.8% across 10 benchmark locations.

Limited land availability continues to be a defining factor. In many areas, a lack of inventory supported competitive bidding when parcels became available, sustaining upward pressure on values.

The dairy sector remains a key driver of demand. Proximity to dairy operations often enhances operational efficiency, increasing competition for nearby land and supporting higher values in those regions.

Upper Midwest Outlook: Stability with Measured Optimism

Across Illinois, Minnesota and Wisconsin, farmland values in 2025 reflected resilience. While lower commodity prices and compressed margins challenged profitability, steady demand and constrained supply prevented broad declines.

Looking ahead to 2026, the outlook suggests continued stability, particularly through the first half of the year. Market participants remain cautious, yet confident in the long-term fundamentals that support farmland as a productive and strategic asset.

Economic Signals Influencing Farmland Values

While crop margins remain tight, recent government support programs and improving price trends for select commodities have helped reinforce cash flow. These factors, combined with farmland’s supply and demand dynamics, have prevented broader pessimism from spilling into land markets.

Macroeconomic forces also play a role. Interest rate policy and broader economic conditions influence financing decisions for both lenders and buyers. Recent rate cuts by the Federal Reserve have eased some pressure, and while additional reductions may be limited, market rates are generally trending in a more supportive direction compared to a year ago.

Looking Ahead

At Agri-Access, we focus on delivering clear, data-drive insight into farmland market conditions. Through consistent benchmark analysis and deep agricultural expertise, we help lenders and landowners navigate uncertainty with confidence.

Informed decisions start with understanding the land, the market and the forces at work. Whether evaluating a single parcel or managing a broader portfolio, Agri-Access serves as a collaborative partner, helping turn opportunity into reality.

Turning possibility into progress

Farmland continues to stand apart as a long-term asset rooted in productivity, scarcity and opportunity. As market conditions evolve, Agri-Access works alongside agricultural lenders to help translate land values and trends into confident, informed decisions.

Subscribe to our Agri-Access newsletter for expert updates and in-depth analysis.

Commentary and expertise provided by Deanne Phelps (certified appraiser in Illinois), Jeff Jens (certified appraiser in Wisconsin), Jeremy Fluegge (certified appraiser in Minnesota) and Megan Roberts (Ag economist)

Agri-Access is a division of Compeer Financial, ACA.